Step 1 / 3

Your download url is loading / ダウンロード URL を読み込んでいます

Step 1 / 3

Your download url is loading / ダウンロード URL を読み込んでいます

IBM doesn’t need any distractions on the highway to changing into a prodigious hybrid-cloud participant, and right now it eradicated a type of diversions by spinning off the $19 billion Managed Infrastructure Providers unit of its World Know-how Providers division.

The transfer creates an as-yet-unnamed agency, tentatively dubbed “NewCo,” which gained’t truly be created till 2021 however will rapidly be a giant supplier of managed infrastructure companies. It’ll make use of about 90,000 staffers, have greater than 4,600 purchasers in 115 nations—together with greater than 75% of the Fortune 100—have a backlog of $60 billion in orders, and greater than twice the dimensions of its nearest competitor, IBM said. That would come with Accenture, Fujitsu and Huawei.

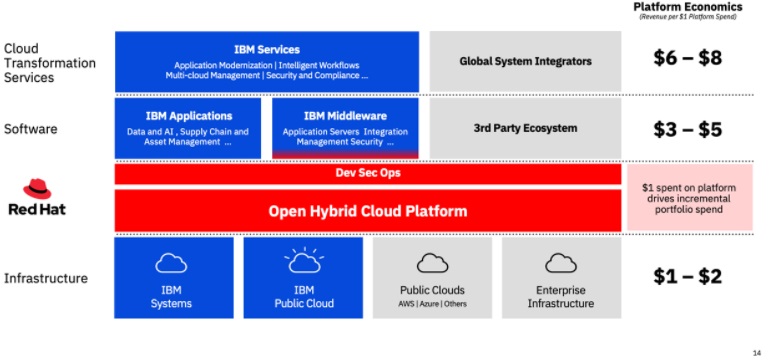

“Shopper shopping for wants for software and infrastructure companies are diverging, whereas adoption of our hybrid cloud platform is accelerating. Now’s the fitting time to create two market-leading corporations targeted on what they do finest,” Arvind Krishna, IBM Chief Govt Officer mentioned in an announcement. “IBM is laser-focused on the $1 trillion hybrid-cloud alternative.”

Most organizations are at the least experimenting with cloud workloads, however many even have a really combined cloud surroundings. Of the organizations working cloud workloads, we estimate at the least 80 % have a multi-cloud surroundings that features entry to each on-prem and public cloud cases, in addition to utilizing a number of suppliers (e.g., AWS, Azure, Google, Oracle, IBM, SAP, and many others.). This makes the world of cloud deployments very complicated.

Arvin, who took the CEO reigns from Virginia Rometty in April, likened the transfer to Large Blue’s earlier massive divestitures equivalent to its determination to do away with its networking enterprise within the 90s and PCs within the 2000s to deal with larger issues.

On this case that larger factor is hybrid-cloud computing.

“Hybrid cloud and AI are swiftly changing into the main target of commerce, transactions, and over time, of computing itself. Our determination can be the logical subsequent step in our pursuit of the $1 trillion hybrid cloud alternative,” Arvin said in a weblog in regards to the transfer.

“Right now, companies account for greater than 60% of our income. When NewCo turns into an impartial firm, our software program and options portfolio will account for almost all of our income,” he said. “This represents a big shift in our enterprise mannequin.”

The acquisition of Crimson Hat for $34 billion in 2019 let IBM construct its hybrid-cloud platform that suspports computing on-premises and in private- and public-cloud environments. “This was the primary main step to grab this chance and underpins all the pieces that has adopted,” Arvin said.

IBM has made plenty of key exchanges with its Crimson Hat know-how. The trouble started with IBM bundling Crimson Hat’s Kubernetes-based OpenShift Container Platform with greater than 100 IBM merchandise in what it calls Cloud Paks to help safety, automation and different key applied sciences. OpenShift lets enterprise prospects deploy and handle containers on their alternative of infrastructure, together with AWS, Microsoft Azure, Google Cloud Platform, Alibaba and IBM Cloud.

One other key transfer was marrying the huge transactional capability, safety and reliability of the Large Iron with Crimson Hat Open Shift and Crimson Hat Enterprise Linux.

“The $34 Billion invested in Crimson Hat has confirmed in a short time to be a sound funding because it has generated double-digit progress and made the corporate immediately extra credible as a competitor and contributor within the hybrid cloud area. That is the place IBM must put the overwhelming majority of its chips if it seeks to fulfill the market the place it’s and ship on the expansion charges that the market needs,” wrote Futurum principal analyst Daniel Newman in a weblog in regards to the IBM transfer.

He expects IBM to deal with hybrid cloud, AI, quantum computing, mainframes and consulting to keep up its deal with enterprise-network modernization, “with out the drag of the $19 billion managed-services enterprise,” Newman said. ““Spin-offs like this are at all times difficult. I don’t count on this one to be seamless both. I do imagine the 2 corporations will each be higher served by having the eye required.”