The necessity for accuracy, pace,and price optimization has thrust automation into the highlight as probably the most important digital transformation drivers—particularly given the occasions of the previous yr. While you have a look at the numbers, expertise like RPA and AI are having their breakout moments as firm leaders notice they’re not good to have, however a business-critical software to remain forward of the competitors.

AI helps organizations execute duties that have been beforehand laborious or in some instances unattainable to realize effectively, successfully, and precisely by leveraging invaluable insights from copious quantities of structured and unstructured information. And it’s due to this ‘large information’ that democratizing information has grow to be a actuality—one the place you take away any gatekeepers that create a bottleneck and restrict entry to necessary data. You not should be an information scientist to entry and perceive what the information is telling you as a result of the logic as to how you utilize the information is unbiased of the method of information technology. The arrival of massive information has actually pushed the rise of AI and the place it’s immediately, corporations should have good historic information to ingest into their AI platforms. The previous adage is true – good information in – good outcomes out.

This method allows cross-team performance and ease of use when interacting with different elements of the enterprise by way of issues like information visualization and dashboards, which will be simply shared and understood by the C-suite all the best way down.

Whereas a lot hype has been produced concerning the speedy tempo of enterprise cloud deployments, in actuality we estimate lower than 25 % of enterprise workloads are at the moment being run within the cloud. That doesn’t negate the significance of the expansion of cloud computing – however it does set some parameters round simply how prevalent it at the moment is, and the way troublesome it's to maneuver enterprise workloads to a cloud structure.

Regardless of a number of corporations already leveraging automation, nowhere is AI at present having the most important affect than on company finance departments, disrupting how finance groups function and work—each inside, and out of doors of, the group. Finance groups have historically been affected by guide processes, human oversight, in addition to legacy expertise. AI is altering all of that by eradicating boundaries and making information far more accessible. Finance groups can now automate advanced monetary and compliance processes equivalent to auditing paperwork—from expense stories and invoices, to packaging slips and receipts.

Three AI applied sciences essential to company finance

As a way to grow to be a very autonomous finance group, it’s very important to leverage three essential AI applied sciences concurrently —Pc Imaginative and prescient (CV), Pure Language Processing (NLP), and Semantic Evaluation (generally known as Semantic Understanding). This mixture ensures the system can perceive structured and unstructured information, whereas persevering with to be taught from billions of transactions, information factors, and consumer suggestions.

Over the previous few years, developments in AI have enhanced Pc Imaginative and prescient expertise to the extent the place we are able to now simply learn textual content from receipts—even when they’re barely legible like those you obtain from yellow cabs. When auditing monetary paperwork, deep studying based mostly CV fashions are operating behind the scene to extract data, whereas state-of-the-art Pure Language Processing methods from numerous analysis establishments assist us perceive the language. NLP is utilized in our on a regular basis lives after we use digital assistants like Siri and Alexa, however companies are beginning to discover purposes to hurry productiveness. For instance, pure language processing expertise is getting used to transcribe conversations in actual time, which may then be used to extract information, permitting for AI to make choices based mostly on this data.

With Semantic Evaluation, you’re capable of perceive and construct relationships between disparate, extracted information like dates, costs, reductions, cost phrases, and line-level spend classes, eradicating the necessity for guide intervention to assessment in any other case unknown or unclassifiable items of information. For instance, let’s say you obtain an bill from a colleague who took a consumer out to dinner a couple of nights in the past—by leveraging semantic classification to attract inferences from the information, the system will have the ability to learn and perceive the receipt and that you simply ordered filet mignon, which is a kind of meat, which is a kind of meals, but additionally that it’s one thing that may be bills in line with firm coverage.

Autonomous AI is driving true digital transformation

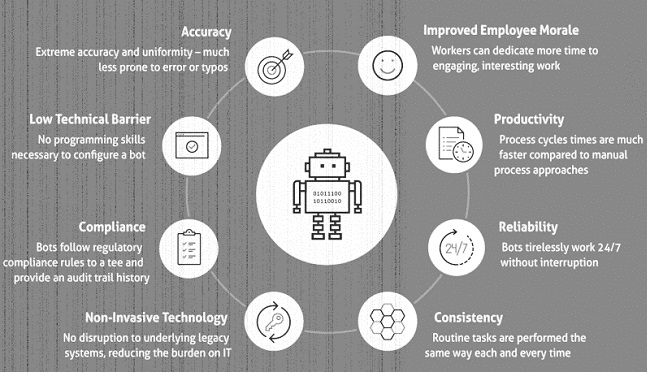

There’s additionally a variety of emphasis being placed on automation with applied sciences like Robotic Course of Automation (RPA), which may simply deal with repeatable duties, handle structured information (solely), and requires a superb quantity of human interplay. Whereas RPA is a helpful expertise and works properly with AI, company finance groups want one thing extra that enables them to harness (each structured and unstructured) large information to grow to be really autonomous, which may solely be accomplished with AI. With accuracy necessities being fairly excessive in finance (e.g. compliance, audits, and many others.), AI adoption has been considerably difficult, however autonomous AI (and the three core AI applied sciences) has been the last word disrupter.

With the ability to course of invoices autonomously—from PDF to paper codecs—permits approvals and choices to be made with out time-consuming guide human assessment that has traditionally taken weeks to perform. Trendy Finance groups require autonomous AI-based options that do the heavy lifting and save time-consuming human assessment just for exceptions. Your group can as an alternative focus consideration on points that require decision, investigation, or nuanced resolution making as an alternative of sorting by way of mountains of bills and invoices. They’ll additionally spend extra time on what they do greatest: forecasting and supporting the corporate’s long-term, strategic monetary objectives and goals.